The repayment of a secured or an unsecured loan depends on the payment schedule agreed upon between both the parties. A short-term loan is categorized as a current liability whereas the unpaid portion of a long-term loan is shown in the balance sheet as a liability and classified as a long-term liability. To illustrate, let’s revisit Sierra Sports’ purchase of soccer equipment on August 1. Sierra Sports purchased $12,000 of soccer equipment from a supplier on credit. Let’s assume that Sierra Sports was unable to make the payment due within 30 days. On August 31, the supplier renegotiates terms with Sierra and converts the accounts payable into a written note, requiring full payment in two months, beginning September 1.

Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger. This is a double entry system of accounting that makes a creditor’s financial statements more accurate. The first of two equal instalments are paid from the company’s bank for 1,00,000 against an unsecured loan of 2,00,000 at 10% p.a. Sierra Sports requires a new apparel printing machine after experiencing an increase in custom uniform orders.

(Figure)You own a farm and grow seasonal products such as pumpkins, squash, and pine trees. Most of your business revenues are earned during the months of October to December. The rest of your year supports the growing process, where revenues are minimal and expenses are high.

Likewise, the company needs to properly make the journal entry for the loan received from the bank as the loan received from the bank will almost always comes with the interest payment obligation. When recording journal entries, it helps to understand how each one works from a historical perspective. Recording a loan received journal entry helps to reduce the double-entry needed for buying on credit. A loan received is a liability on a company’s balance sheet, usually payable in one year. (Figure)Airplanes Unlimited purchases airplane parts from a supplier on March 19 at a quantity of 4,800 parts at $12.50 per part.

The Accounting University with 3400+ Accounting contents as study material which can watch, read and learn anyone, anywhere.

You can read it to get a clear idea of the loan received journal entry without any confusion. (Figure)Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from the bank in the amount of $310,000. The terms of the loan are 6.5% annual interest rate, payable in three months.

The repayment of loan depends on the schedule agreed upon between both parties. A short-term loan is categorized as a current liability whereas a long-term loan is capitalized and classified as a long-term liability. This journal entry will increase both total expenses on the income statement and total liabilities on the balance sheet. Sometimes, the company may receive a loan from a bank in order to operate or expand its business operation.

Time Tracking Solution Market: Regional Segments 2023 Growth … – Digital Journal

Time Tracking Solution Market: Regional Segments 2023 Growth ….

Posted: Tue, 22 Aug 2023 05:15:18 GMT [source]

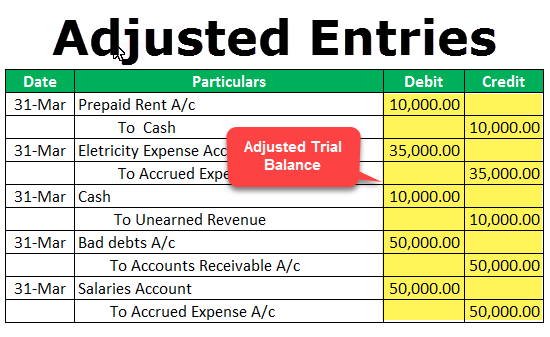

Bank fees and prepaid interest might cause these two amounts to slightly differ. A short-term notes payable created by a purchase typically occurs when a payment to a supplier does not occur within the established time frame. The supplier might require a new agreement that converts the overdue accounts payable into a short-term note payable (see (Figure)), with interest added. This gives the company more time to make good on outstanding debt and gives the supplier an incentive for delaying payment. When the company pays back the principal of the loan received from the bank, it can make the journal entry by debiting the loan payable account and crediting the cash account. The company can make the journal entry for the loan received from the bank by debiting the cash account and crediting the loan payable account.

Journal entry for a bank loan repaid in full

A loan is an asset but consider that for reporting purposes, that loan is also going to be listed separately as a liability. Secured loans are loans backed with something of value that you own. Common examples of collateral include your vehicle or other valuable property such as jewelry,land etc.. Amy is a Certified Public Accountant (CPA), having worked in the accounting industry for 14 years. She is a seasoned finance executive having held various positions both in public accounting and most recently as the Chief Financial Officer of a large manufacturing company based out of Michigan. As per the accounting equation, Total Assets of a company are the sum of its Total Capital and Total Liabilities.

- The business may also require an influx of cash to cover expenses temporarily.

- There are many different reasons why a company might need to borrow money, such as to purchase new equipment, hire and pay employees, or purchase inventory.

- This means that the principal portion of the payment will gradually increase over the term of the loan.

- Let’s assume that a company obtains a $30,000 bank loan that must be repaid within 9 months.

- As a result, the corporation will need to make a journal entry for the loan interest later.

Record the journal entries to recognize the initial purchase, the conversion, and the payment. Accounts Payable decreases (debit) and Short-Term Notes Payable increases (credit) for the original amount owed of $12,000. When Sierra pays cash for the full amount due, including interest, on October 31, the following entry occurs. Short-term debt may be preferred over long-term debt when the entity does not want to devote resources to pay interest over an extended period of time. In many cases, the interest rate is lower than long-term debt, because the loan is considered less risky with the shorter payback period. This shorter payback period is also beneficial with amortization expenses; short-term debt typically does not amortize, unlike long-term debt.

Journal entry for a loan received from a bank

School boards approve the note issuances, with repayments of principal and interest typically met within a few months. We now consider two short-term notes payable situations; one is created by a purchase, and the other is created by a loan. Debt sale to a third party is a possibility with any loan, which includes a short-term note payable. The terms of the agreement will state this resale possibility, and the new debt owner honors the agreement terms of the original parties. A lender may choose this option to collect cash quickly and reduce the overall outstanding debt.

Making a Journal Entry to show a loan that has been taken out can be complex. Ask your accountant how the entry should be made and what accounts should be used. Let’s say you are a small business owner and you would like a $15000 loan to get your bike company off the ground. You’ve done your due diligence, the bike industry is booming in your area, and you feel the debt incurred will be a small risk. You expect moderate revenues in your first year but your business plan shows steady growth.

What is a Loan Payment?

To record the accrued interest over an accounting period, debit your Accrued Interest Receivable account and credit your Interest Revenue account. Only the interest portion of a loan payment will appear on your income statement as an Interest Expense. The principal payment of your loan will not be included in your business’ income statement. In this article, we have discussed a simple example of recording loan received journal entries.

- Obtaining a loan from a bank or other financial institution is a common way for companies to access the financial resources they need to fund their operations and support their growth.

- A loan is an asset but consider that for reporting purposes, that loan is also going to be listed separately as a liability.

- The supplier renegotiates the terms on April 18 and allows Airplanes to convert its purchase payment into a short-term note, with an annual interest rate of 9%, payable in six months.

- The nature of the transaction determines the position of a loan received on the balance sheet.

Let’s say you are responsible for paying the $27.40 accrued interest from the previous example. Your journal entry would increase your Interest Expense account through a $27.40 debit and increase your Accrued Interest Payable account through a $27.40 credit. If you are the company loaning the money, then the “Loans Receivable” lists the exact amounts of money that is due from your borrowers. This does not include money paid, it is only the amounts that are expected to be paid. The difference between a loan payable and loan receivable is that one is a liability to a company and one is an asset.

Interest is now included as part of the payment terms at an annual rate of 10%. The conversion entry from an account payable to a Short-Term Note Payable in Sierra’s journal is shown. When using the accrual method of accounting, interest expenses and liabilities are recorded at the end of each accounting period instead of recording the interest expense when the payment is made. You can do this by adjusting entry to match the interest expense to the appropriate period. Also, this is also a result of reporting a liability of interest that the company owes as of the date on the balance sheet. A long-term liability account is used to record liabilities that are due more than one year in the future.

In your bookkeeping, interest accumulates on the same periodic basis even if the interest is not due. This interest is debited to your expense account and a credit is made a liability account under interest payable for the pending payment liability. Banks and lenders charge interest on their loan repayment on a periodical basis. The period can be monthly or semi-annually with interest paid out based on a payment schedule. The company borrowed $15,000 and now owes $15,000 (plus a possible bank fee, and interest).

Stay up to date on the latest accounting tips and training

Cash increases (debit) as does Short-Term Notes Payable (credit) for the principal amount of the loan, which is $150,000. When Sierra pays in full on December 31, the following entry occurs. Let’s assume that a company obtains a $30,000 bank loan that must be repaid within 9 months. The bank deposits the loan proceeds of $30,000 into the company’s checking account at the same bank. Now, let’s say your customer owes you $27.40 in accrued interest. Your journal entry should increase your Interest Expense account through a debit of $27.40 and increase your Accrued Interest Payable account through a credit of $27.40.

Airplanes pays one-third of the amount due in cash on March 30 but cannot pay the remaining balance due. The supplier renegotiates the terms on April 18 and allows Airplanes to convert its purchase payment into a short-term note, with an annual interest rate of 9%, payable in six months. (Figure)Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 6,000 treats at $1 per treat. Barkers pays half the amount due in cash on February 28 but cannot pay the remaining balance due in four days.

Is a Loan an Asset?

The supplier renegotiates the terms on March 4 and allows Barkers to convert its purchase payment into a short-term note, with an annual interest rate of 6%, payable in 9 months. The bank will record the loan by increasing a current asset such as Loans to Customers or Loan journal entry Loans Receivable and increasing a current liability such as Customer Demand Deposits. When recording periodic loan payments, first apply the payment toward interest expense and then debit the remaining amount to the loan account to reduce your outstanding balance.

The Accounting Cycle: 8 Steps You Need To Know – Forbes

The Accounting Cycle: 8 Steps You Need To Know.

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

There is an ebb and flow to business that can sometimes produce this same situation, where business expenses temporarily exceed revenues. Even if a company finds itself in this situation, bills still need to be paid. The company may consider a short-term note payable to cover the difference.

0 Comment